Hooray! Lenders are back lending, especially for multi-family transactions in the Portland, Oregon metro area. Here are the top four trends we saw in 2012 and most likely will continue to see in 2013:

1. Rates/Terms

We

are still seeing lenders

requiring 25%-30% down

4-5% interest rate

30 year amortization

2. Lender qualifications

Basic guidelines that lenders want for buyers to qualify for purchase or refinance with apartments:

-Borrower to have 9-12 months debt service payments cash ready after closing.

-Borrow to have a net worth approximately equal or greater to the loan amount.

-Property to ha

ve a 1.2 debt service coverate

-Borrower's apartment resume CRITICAL, as banks want to see more borrower strength in operations.

3. Buyer ownership/operation resume

This key point that lenders are focusing on now: what is the experience of the borrower? Have they operated properties successfully in the past? What specifically have they operated?

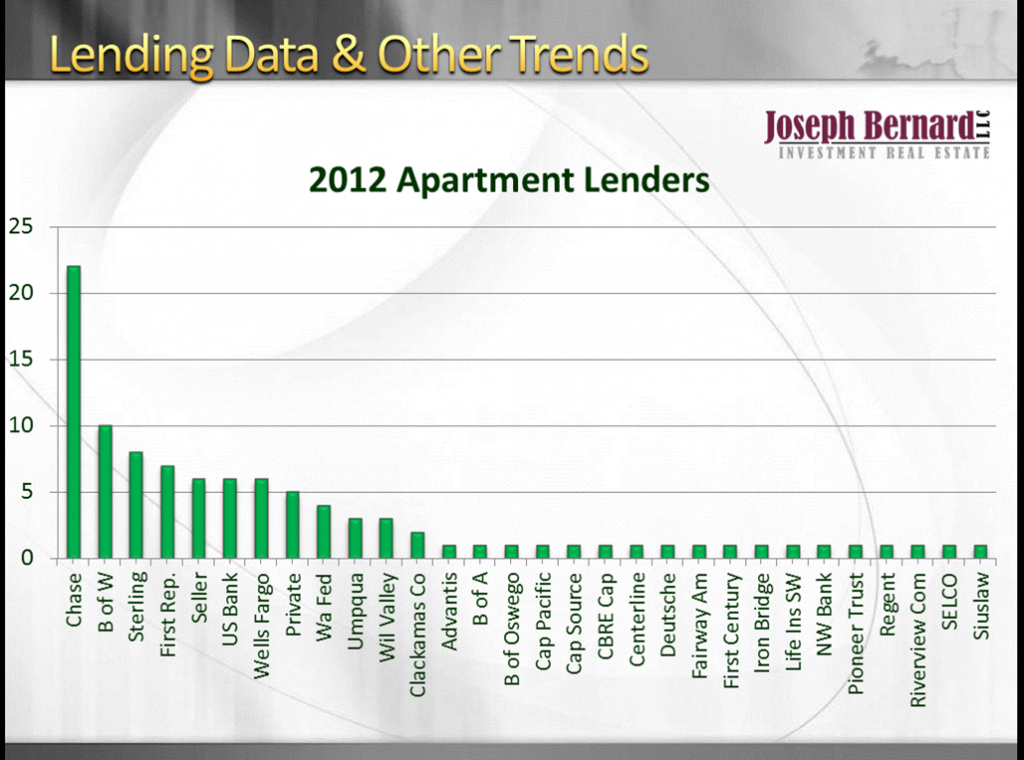

4. Who is lending?

In the Portland, Oregon market, Chase Bank is clearly the overall winner with approximately 22 new purchases financed. Here is the breakdown of the 5-100 apartment unit range lenders: